The Greatest Thing to Fear is…

Submitted by Monument Group Wealth on October 23rd, 201310/24/2013

Dear Clients and Friends:

We hope this quarterly letter finds you well and enjoying the autumn.

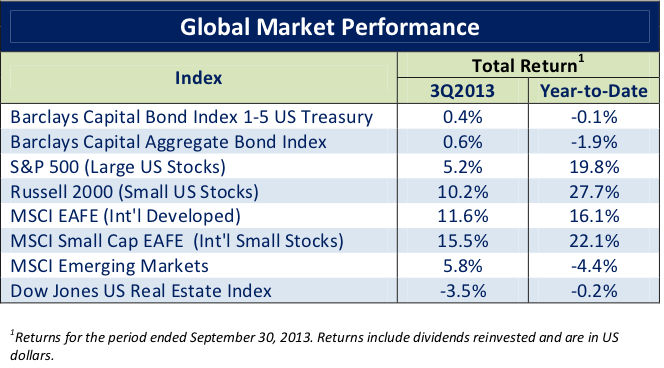

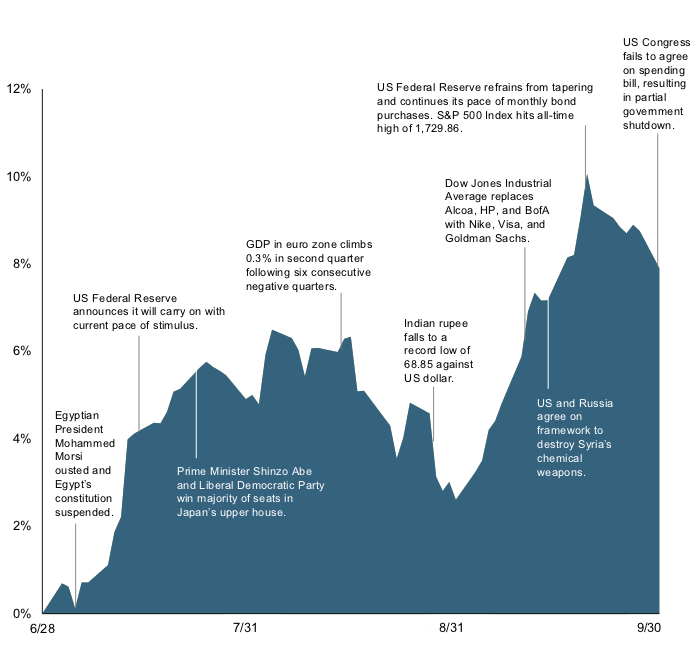

In this quarter’s letter, we include the Global Market Performance chart, our brief market comments, a bit on bonds and bubbles (of the economic and market sort) and the Timeline of Events.

The Greatest Thing to Fear is...

Despite being confronted with several threatening headwinds (Syria, potential Federal Reserve tapering, a looming government fiscal showdown, fear of contagion from the nation’s largest municipal bankruptcy and the NASDAQ going dark due to technical glitches), equity markets continued the ascent. Equities continued to climb the proverbial wall of worry and posted strong gains across nearly every asset class, with the exception of the US real estate market (publicly traded real estate investment trusts). In a testament to the resilience of companies and the economy as a whole, this positive performance came in the face of headlines dominated by big picture economic and political uncertainty. The chart below shows the quarterly returns for various equity and bond markets for the third quarter and year to date.

Bonds, Bubbles and (why worry about the) Babble

Are bonds too risky? A good question asked by a lot of smart folks. The answer isn’t as simple as the “Bond Bubble” headlines may lead us to believe. These headlines describe bonds as today’s riskiest asset class.

So, what is a bubble, are bonds in a bubble and should we give credence to the babble in the press? A bubble, in terms of asset values, can best be described by examples. Recent bubbles have included the dot-com bubble of 2000/2001 and the real estate bubble of the mid-2000s. Further back we have the Dutch tulip bulbs of the 1630s, US railroad stocks in the 1840s, the US stock market of the Roaring Twenties and Japanese stocks and real estate of the 1980s. In each case, asset prices increased beyond their true value and the bubbles ended in crashes.

In terms of bonds, the many bubblishers (our newly minted term for those that publish the bond market bubble headlines) point out that US Treasury yields have dropped to a point where there is no place to go but up. Given that bond prices fall when yields increase, the common conclusion is that when yields go up, the bond market will crash. Certainly this argument deserves attention and we recognize the simplicity of our explanation. After all, the price of long-term government bonds is down more than 10% in the last 12 months and a bond market crash would have other ramifications across the economy. However, the attention given to the argument should be to elect out of purchasing long-term bonds and elect into a globally diversified portfolio of equities and short-term, high-quality bonds.

The final question is should we worry about the babble? If you read the piece in our last quarterly letter entitled “The Art of Letting Go,” then you understand that our answer is a resounding: “No.” We are advocates of avoiding the riskier long-term government bonds and, on the other end of the credit spectrum, high-yield bonds (aka junk bonds). We are believers in preserving capital via short-term, high quality bonds. The role for these bonds is to preserve capital and allow equities to do their work. When equities take a breather, the short- term, high quality bonds act as an anchor to protect the portfolio.

If you have any questions regarding your portfolio report or the other items, please be in touch. As always, we welcome your suggestions and feedback and value your trust and confidence.

Sincerely,

Byron E. Woodman, Jr.

President

Lee C. McGowan, CFP®

Managing Director

Attachments:

13-3Q Quarterly Letter.pdf Size: 158.57 KB